- February 24, 2015

- 1 Comment

- in Tips and hints

How to get your superannuation back when you leave Australia

Free Money, free money, read all about it! Or so it seems.

This money is not 'free' but it will cost you if you don't collect it.

With our guide on how to get your superannuation back, you'll be seeing the money back in your account in no time.

What is it?

Superannuation is mandatory for all workers in Australia. You would have noticed it in your contracts, whether it was a working holiday visa short term thing or a 457 contract. Your contracts might say a certain salary amount 'plus super'. This 'super' refers to superannuation.

More correctly, it's an obligation on employers to contribute money towards a superannuation fund that you cannot touch until retirement. Think of it as your nest egg.

Why do they have this?

Because the Australian government makes sure that everyone has something for retirement when the time comes by making everyone save during their working lives - including foreign nationals who are here temporarily.

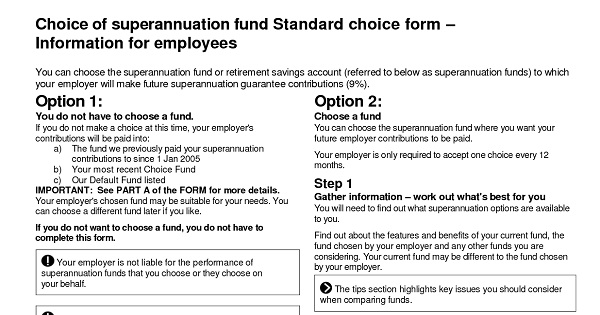

When you start working, somewhere in the little pink forms and other contract documents you'll find one that says you can either go with the superannuation fund that the employer uses or you can choose your own. Most people go with what the employer says, particularly foreign workers because who has time to go through all the super funds when you just really want to get started with work? If you want to read more, here's some handy information from the Australian Tax Office (ATO).

So what does this all mean?

This means that every time you get paid, 9.25% of YOUR money gets squirreled away into a super fund where it stays there till you retire or when you withdraw it on exceptional circumstances.

So when you leave Australia after your work contract or visa expires, you're leaving behind more than just your friends, new way of life and/or paradise; you're leaving behind a big chunk of money!

How do I get it back?

Luckily, you still have the rights to it and you can get it back with a few forms - even when you've gone back to your own country or moved onto greener pastures outside of our borders.

There are 2 ways you can do this:

- Online with the ATO

- Paper applications to your superannuation fund

The best way to do it?

At Frontier Migration Services we use technology to our advantage and benefit so of course we recommend that you do it online with the ATO!

This ATO service is free whereas to submit an application to your super fund requires more steps and more money - and it's a paper application.

How does it work?

The ATO is linked to the Department's system that will verify your immigration status.

When your visa is confirmed as having ceased to be in effect and that you've left the country, you'll be able to get your money back.

What do I need to do?

Important words are "ceased to be in effect".

Say you're on a working holiday visa that is valid for 12 months. You arrive in Australia in January and you travel around, work a little and have the time of your life, but you decide that you've had enough and you want to go home around August. You go home and you try to claim your super back but ERROR WARNING ERROR - you can't.

Why? Well its because your visa is still valid until December. Just because you leave in August, doesn't mean your visa has expired, you could very well come back from September to December.

You need to request to cancel your temporary resident visa!

Note: You are cancelling a visa. You should only do this if you really have left the country and do not intend to come back. You cannot be in Australia when you cancel your visa or you will be illegal.

To request a visa cancellation, fill in the relevant sections of this form: Form 1194 Certification of immigration status and/or request to cancel a Temporary Resident visa.

Where do I send the form?

Email: Super.hobart@immi.gov.au

Post:

Certification of Immigration Status

Department of Immigration and Citizenship

GPO Box 1496

Hobart Tas. 7001

Fax: +61 3 6281 9453

(You will receive notification from the Department of your requested visa cancellation.)

How to apply to the Australian Tax Office (ATO)

Now you just claim your super at the ATO.

Simply click the link to the DASP online application system and enter your details including:

- Name

- Date of birth

- Email address

- Passport country

- Passport number

- Australian tax file number (TFN)

What next?

If you have completed the forms correctly then you will just need to wait and your money will be returned to you.

Not sure if you have covered all your super funds? Maybe you switched jobs so many times you've lost track, you can use this tool from the ATO to check whether you have any unclaimed super hiding in funds somewhere. Check it now here.

For further information and full details on how to apply through your superannuation fund (paper based and for a fee) click here.

We suggest you start this process early if you know you will be leaving Australia permanently because who doesn't want a big chunk of money waiting for them in their home bank accounts when you return? I know I would.

Get your superannuation back today!

ONE COMMENT ON THIS POST To “How to get your superannuation back when you leave Australia”